Intuit’s Quicken Online purports to offer a simple, all-in-one control panel that lets you easily monitor and manage your monthly finances. For the basics, it succeeds, but users who need complete control may find themselves wanting more, especially for $2.99 per month.

What’s your problem? I use four different sites to manage my finances online: one for my brokerage accounts, another for my 401(k), one for my credit cards, and yet another for my checking and savings accounts. Because 90% of my online financial activities requires nothing more than a quick balance check and a look at recent transactions, I’m on the hunt for an easy, secure application that I can use to aggregate the information without having to hop from site to site to site. I’d also love integrated budgeting features, so that I can compare my spending vs. personal goals.

Enter Intuit’s Quicken Online, which I first came across through Lifehacker’s personal finance tips (full disclosure: I have nothing to do with Lifehacker). The promise was there – a simple, one-stop interface that lets you easily monitor all of your financial accounts, and a breakdown of your expenditures in a monkey-couldn’t-get-confused-by-it pie chart. I’d used Intuit’s online TurboTax for years to handle my tax returns, so Quicken Online also offered something that is an absolute must for any type of bank account aggregator: security that I can trust (I hope).

As the video on the Quicken Online site promises, setup was a snap. Sign up for the 30-day free trial ($2.99 per month after that), enter your bank names and login information, and the application automatically retrieves the last 90 days’ worth of transactions. Once all your data is available, you’re presented with the home dashboard, which features the most basic look at your finances: three boxes representing your income, your expenditures, and the differential:

Confirmation of my profligate spending, complete with pastel Web 2.0 gradients. We’re off to a good start.

The dashboard also provides a quick look at all your account balances, broken out by bank, and a customizable list of bill alerts, which sends a “pay your bills” reminder to either an email address or mobile device via SMS.

The site features two other main categories: My Accounts, which lets you add, remove, and otherwise manage your account settings (which we will totally ignore for now), and Track Spending, which is where you’ll spend most of your time.

Track Spending offers the aforementioned pie chart, which breaks your spending down into both pre-assigned and user-created categories (such as rent, travel, paycheck, etc.). You can also view all the transactions that contribute to each category.

The pie chart breaks down your expenses by type…

![]()

And the menus allow you to drill down in each category…

Which lets you see how you spent your money. By the way, if you’re ever at the Atlantis, try the Leap of Faith water slide. Just trust me on this.

Quicken tries to automatically assign your imported transactions to one of its pre-defined categories and, for the most part, it does a good job. It did initially list a number of transactions as undefined, such as my monthly rent payment, but you can easily reassign those wayward expenditures and deposits to their proper categories.

The one big gotcha I noticed with the initial setup is that Quicken Online, in Costanza-like fashion, double dips expenses – it interpreted both the purchases I put on my credit card and the payments that I made from my bank to my credit card companies as expenses, so it looked like I had spent twice what I had actually paid. The fix involved a transaction type called “Transfer Out,” which you use to classify a payment that shouldn’t count towards your total expenditures. Fixing the double dip was the most difficult part of setting up the account, and it took a total of about five minutes.

Since setup, managing the application has required very little maintenance – switch a random uncategorized transaction here and there, make sure that my bank’s web site allows Quicken to refresh account balances, and that’s it. I can say with some reliability how much I’m spending on what, and whether or not I’m hitting that magic threshold of living within my means.

For support, users have access to the Quicken Online blog and User Community forums. The blog is updated regularly, but the forums tend to be filled with unanswered questions, and aren’t much use. You can also contact Intuit support directly.

Sounds like the perfect solution! So far, so good. But Quicken Online isn’t perfect. As an anal control freak, one of the biggest problems I had with the service is that you can’t split transactions; that is, designate multiple purposes for a single expense. For people with mortgages, who need to differentiate interest from capital for tax purposes, or for people who just want to say “I split that $100 ATM withdrawal among dinner, drinks and White Castle at 3 AM,” this lack of functionality could be a deal breaker.

For $2.99/month, I also would have liked even rudimentary budgeting features, such as alerts when my monthly spending in a specific category reaches a pre-determined limit. These shortcomings are especially problematic for Intuit because competitor mint.com offers split transactions, comparable security and, most importantly for many people who are looking for a cheap budget/finance tool, the service is free (although it is ad-supported, which Quicken is not).

So what’s the bottom line? Quicken Online does what it says it does: it presents you with an easy-to-read view of your financial transactions. Setup is easy, maintenance isn’t a problem, and if all you want to do is get the bottom line, Quicken Online does it. The only reason I have a hard time recommending it is the price: even at $2.99/month, the service is overpriced for what it does.

Competitors offer everything that Quicken Online does, plus personal budgeting features (a feature that Quicken’s blog claims is coming soon), and it’s free. Quicken Online is better than manually updating a spreadsheet to track your spending, and easier than using the full offline version of Quicken, but if all you’re looking for is something to give you a quick overview of your finances, and maybe some basic planning functions, you might be just as satisfied somewhere that doesn’t ding you with a monthly fee.

Short answer: You Can’t. They are inherently distracting services, regardless of whether or not they are useful or relevant to you in a work capacity.

Short answer: You Can’t. They are inherently distracting services, regardless of whether or not they are useful or relevant to you in a work capacity. For the rest of us, it’s noisy and distracting. And it doesn’t matter if you have notifiers on or off, because using either communication stream effectively requires participation. Sure, you can just read a series of streams, and that’s better than nothing, but not by much. Part of the point of it all is being engaged.

For the rest of us, it’s noisy and distracting. And it doesn’t matter if you have notifiers on or off, because using either communication stream effectively requires participation. Sure, you can just read a series of streams, and that’s better than nothing, but not by much. Part of the point of it all is being engaged. The next-best solution?

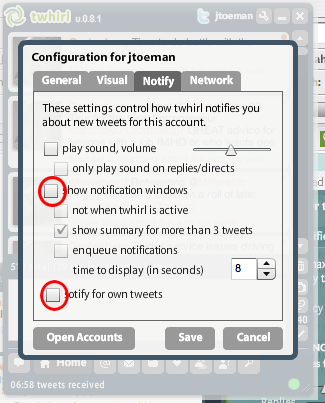

The next-best solution?  Tech: Turn down/off your notification settings (I recommend the same for email, btw). Anything that can pop up over your actual work should go away.

Tech: Turn down/off your notification settings (I recommend the same for email, btw). Anything that can pop up over your actual work should go away.

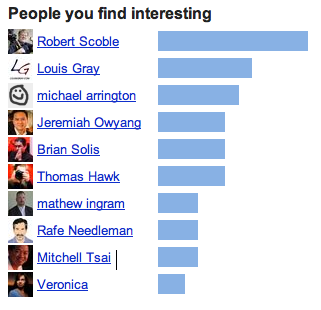

Use “interestingness” more – The current list of “who’s subscribed to me” is stagnant, calculated by some ranking. Use the info from the stats page to show a more dynamic list.

Use “interestingness” more – The current list of “who’s subscribed to me” is stagnant, calculated by some ranking. Use the info from the stats page to show a more dynamic list. Fix the glaring typo on this page

Fix the glaring typo on this page